Content Outline:

1. Introduction to Cryptocurrency

- Definition of Cryptocurrency

- Brief History of Cryptocurrency

- Purpose and Importance of Cryptocurrencies in the Modern Economy

2. How Does Cryptocurrency Work?

- Explanation of Blockchain Technology

- The Role of Miners and Nodes

- Security Features of Cryptocurrencies

3. Different Types of Cryptocurrencies

- Overview of Popular Cryptocurrencies (Bitcoin, Ethereum, etc.)

- Altcoins and Their Significance

- Stablecoins and Their Use Cases

4. The Process of Buying and Selling Cryptocurrency

- Setting up a Digital Wallet

- Choosing a Cryptocurrency Exchange

- Step-by-Step Guide to Buying Cryptocurrency

5. Cryptocurrency Investment Strategies

- Long-term vs. Short-term Investing

- Understanding Market Volatility

- Risk Management in Cryptocurrency Trading

6. Regulatory Environment for Cryptocurrencies

- Overview of Global Cryptocurrency Regulations

- How Different Countries Approach Cryptocurrency

- The Future of Cryptocurrency Regulation

7. Conclusion

- Summary of Key Points

- The Future of Cryptocurrency and Its Potential Impact on Finance

Related Questions:

1. What is the difference between cryptocurrency and traditional currency?

2. How do you securely store your cryptocurrency?

3. What are the risks associated with investing in cryptocurrency?

4. How can one avoid scams in the cryptocurrency space?

5. What are the tax implications of investing in cryptocurrencies?

6. How is blockchain technology changing industries beyond cryptocurrency?

---

## Content

### 1. Introduction to Cryptocurrency

Cryptocurrencies have revolutionized the financial landscape, creating new opportunities for investment and financial technology. At its core, a cryptocurrency is a type of digital or virtual currency that uses cryptography for security, making it difficult to counterfeit or double-spend. This unique feature, combined with decentralized control through blockchain technology, sets cryptocurrencies apart from traditional financial systems.

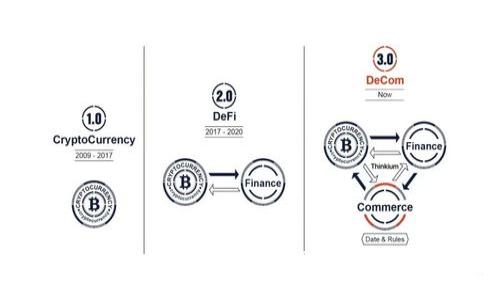

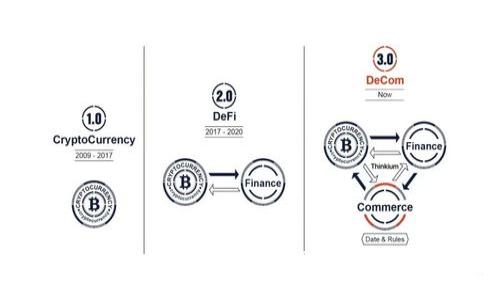

The concept of cryptocurrency emerged in the late 2000s, with Bitcoin being the first and most recognized digital currency. Since then, thousands of altcoins have been developed, each with distinct features and intended uses. The importance of cryptocurrencies lies not only in their potential for investment but also in their ability to provide financial services to unbanked populations, enhance transaction speed and transparency, and create new economic models.

### 2. How Does Cryptocurrency Work?

To truly understand cryptocurrency, one must first grasp the underlying technology that powers it—blockchain. Blockchain is a distributed ledger that records all transactions across a network of computers. Each block in this chain contains a list of transactions, and once a block is filled, it is linked to the previous block, creating a secure and unalterable record.

In a cryptocurrency network, miners play a crucial role by validating and recording transactions. They use powerful computers to solve complex mathematical problems, and in return, they earn new coins. Nodes, which are computers that maintain copies of the blockchain, help secure the network by verifying transactions and communicating with other nodes.

The security of cryptocurrency is a significant feature. The use of cryptographic techniques ensures that transactions are secure, and the decentralized nature of blockchain reduces the likelihood of fraud. As a result, cryptocurrencies can operate without a central authority, providing users with more control over their assets.

### 3. Different Types of Cryptocurrencies

Although Bitcoin is often referred to as the king of cryptocurrencies, many other digital currencies have emerged, serving various purposes. Ethereum, for instance, introduced the concept of smart contracts, allowing developers to create decentralized applications (dApps) on its platform. Other popular cryptocurrencies include Ripple (XRP), which focuses on enabling real-time cross-border payments, and Litecoin, which offers faster transaction times than Bitcoin.

Altcoins refer to all cryptocurrencies other than Bitcoin. They can provide unique features or enhancements over Bitcoin or can be aimed at entirely different use cases. For example, stablecoins are pegged to the value of traditional currencies or commodities, ensuring price stability and making them suitable for transactions without the volatility typically associated with cryptocurrencies.

### 4. The Process of Buying and Selling Cryptocurrency

If you're interested in acquiring cryptocurrency, the first step is to set up a digital wallet. A digital wallet is a software application or hardware device that allows you to store and manage your digital assets securely. There are several types of wallets, including hot wallets (connected to the internet) and cold wallets (offline storage), each offering different levels of security and accessibility.

Once you have a wallet, the next step is to choose a trustworthy cryptocurrency exchange, such as Binance, Coinbase, or Kraken. After creating an account and verifying your identity, you can begin purchasing cryptocurrency. The process typically involves depositing funds into your exchange account and then selecting the cryptocurrency you wish to buy. Remember to consider transaction fees and the current market price before making a purchase.

### 5. Cryptocurrency Investment Strategies

Investing in cryptocurrency can be both rewarding and risky, and understanding different investment strategies is crucial. Long-term investors often adopt a buy-and-hold strategy, believing that the value of cryptocurrencies will increase over time. This approach requires patience and a sound understanding of market trends and project fundamentals.

On the other hand, short-term traders may engage in day trading or swing trading, capitalizing on price fluctuations. This requires rapid decision-making and a strong grasp of market analysis. Regardless of the strategy, effective risk management is essential. Setting stop-loss orders and diversifying your portfolio can help mitigate potential losses.

### 6. Regulatory Environment for Cryptocurrencies

The regulatory landscape surrounding cryptocurrencies is rapidly evolving. Different countries have varying approaches to regulation, with some embracing cryptocurrencies and others imposing restrictions or outright bans. For instance, countries like El Salvador have adopted Bitcoin as legal tender, while China has enacted strict regulations against cryptocurrency trading.

The future of cryptocurrency regulation is uncertain, as governments work to balance innovation with consumer protection. As more financial institutions explore blockchain technology, it's likely that clearer regulatory frameworks will emerge, impacting how cryptocurrencies can be used and traded globally.

### 7. Conclusion

Cryptocurrency represents a significant shift in our understanding of money and finance. Its decentralized nature presents new opportunities for investment, innovation, and social impact. As we look ahead, the evolution of cryptocurrency and blockchain technology will continue to shape global finance, offering exciting possibilities for those willing to embrace this digital revolution.

---

### Related Questions

#### 1. What is the difference between cryptocurrency and traditional currency?

Cryptocurrencies differ from traditional currencies in multiple ways, including their underlying technology, issuance methods, and regulatory status. Traditional currencies, also known as fiat currencies, are issued by governments and have physical forms, such as banknotes and coins. They are also regulated by central authorities, such as central banks, which manage monetary policy and control supply.

In contrast, cryptocurrencies are decentralized and rely on blockchain technology for transactions. They exist only in digital form and are created through a process called mining, where individuals use computational power to validate transactions on the network. This decentralization provides users with greater control over their assets, reducing the influence of centralized authorities.

Additionally, traditional currencies can be subject to inflationary pressures due to government policies. Cryptocurrencies like Bitcoin, however, have a capped supply, which can create deflationary dynamics. This difference in supply mechanics is one reason many investors view cryptocurrencies as a hedge against inflation.

#### 2. How do you securely store your cryptocurrency?

Securing cryptocurrency is crucial to protect against theft and loss. The first step is choosing the right type of wallet. Hot wallets, while convenient for trading, are more susceptible to hacks. For long-term storage, cold wallets, such as hardware wallets or paper wallets, provide enhanced security. These wallets are not connected to the internet and are less prone to cyber threats.

Once you've chosen a wallet, it’s essential to follow best practices for security. Use strong, unique passwords and enable two-factor authentication whenever possible. Regularly backup your wallet information and store backup copies in a secure location.

Additionally, remain vigilant against phishing attacks and malicious software. Always verify the URLs of websites you visit and never share your private keys or passwords. By taking these precautions, you can significantly reduce the risk of losing your cryptocurrency.

#### 3. What are the risks associated with investing in cryptocurrency?

Investing in cryptocurrency comes with various risks that potential investors should be aware of. The first and foremost risk is market volatility. Cryptocurrency prices can fluctuate wildly within short time frames, leading to significant gains or losses. This volatility can be intimidating for investors accustomed to more stable asset classes.

Another risk is regulatory uncertainty. Governments worldwide are still grappling with how to regulate cryptocurrencies, resulting in a constantly changing landscape. New regulations can affect market accessibility, trading practices, and investment opportunities.

Security risks are also prevalent. Cryptocurrency exchanges and wallets can be hacked, leading to the loss of funds. It is vital to choose reputable platforms and prioritize security measures to mitigate this risk. Investors must also be cautious of scams, such as phishing schemes and Ponzi schemes, which can target unsuspecting individuals.

Lastly, the lack of consumer protections in the cryptocurrency space means that if you lose access to your wallet or your funds are stolen, recovering them is often impossible. This underscores the need for due diligence and cautious investment practices.

#### 4. How can one avoid scams in the cryptocurrency space?

Scams in the cryptocurrency world are unfortunately common, and investors must remain vigilant to protect their assets. One of the most effective ways to avoid scams is thorough research. Always investigate the legitimacy of a cryptocurrency project by examining its whitepaper, team members, and community feedback. Look for information on their website, social media channels, and forums to assess credibility.

Be cautious with unsolicited offers or investment opportunities promising high returns with little risk. If it sounds too good to be true, it probably is. Avoid sharing personal information or your private keys with anyone.

Using reputable exchanges and wallets is crucial for safeguarding your investments. Check reviews and ratings from trusted sources and opt for platforms with robust security measures in place.

Finally, educate yourself about common scams, such as phishing attacks, Ponzi schemes, and fake ICOs. Being informed and skeptical can help shield you from falling victim to fraudulent schemes.

#### 5. What are the tax implications of investing in cryptocurrencies?

Tax implications for cryptocurrency investments vary by country, but many jurisdictions consider cryptocurrencies as taxable assets. In the United States, for instance, the Internal Revenue Service (IRS) treats cryptocurrencies as property. This means that every time you sell, trade, or use cryptocurrency for purchases, you may incur capital gains or losses, which must be reported on your tax return.

It’s essential to keep accurate records of all transactions involving cryptocurrencies, including the date, value, and purpose of each transaction. This documentation will be crucial for calculating taxes owed.

Some countries have made efforts to simplify tax options for cryptocurrency investors, allowing exemptions for smaller transactions or providing guidelines for specific uses. However, in most cases, failing to report cryptocurrency transactions can result in penalties.

Investors should consult with tax professionals familiar with cryptocurrency regulations to ensure compliance with local laws and optimize their tax strategies.

#### 6. How is blockchain technology changing industries beyond cryptocurrency?

Blockchain technology, the backbone of cryptocurrencies, has applications that extend far beyond the financial sector. One of the most notable uses is in supply chain management. Blockchain can enhance transparency and traceability by recording every step of a product's journey from source to consumer. This allows companies to verify authenticity and ensure ethical sourcing.

Healthcare is another industry benefiting from blockchain technology. It can securely store and share patient records, facilitating interoperability between providers while maintaining patient privacy. Smart contracts on blockchain can automate insurance claims processing, leading to faster and more efficient payments.

Additionally, blockchain is being explored in the field of voting. By using secure, transparent blockchain systems, governments can reduce the likelihood of fraud and increase voter participation through accessible and verifiable voting processes.

Overall, blockchain's ability to provide secure, transparent, and decentralized solutions is making it a transformative technology across various sectors, signalling a shift toward greater efficiency and accountability.

---

This comprehensive overview provides an introduction to cryptocurrency, explores key concepts, investment strategies, and important considerations for navigating this increasingly popular financial landscape.

tpwallet

TokenPocket是全球最大的数字货币钱包,支持包括BTC, ETH, BSC, TRON, Aptos, Polygon, Solana, OKExChain, Polkadot, Kusama, EOS等在内的所有主流公链及Layer 2,已为全球近千万用户提供可信赖的数字货币资产管理服务,也是当前DeFi用户必备的工具钱包。